Lido Staking Guide | Stake Ethereum and Earn stETH Rewards 💧🚀

Ethereum has changed the financial world — but Lido completely reinvented the staking era.

Gone are the days when your ETH sat idle, locked and waiting for withdrawal queues.

Welcome to Lido, the future of liquid staking — where your Ethereum stays flexible, grows daily, and remains under your total control.

This Lido Staking Guide is made for those who don’t just hold ETH — they make it work.

Whether you’re a first-time staker or managing a whale-size portfolio, this guide gives you every step, every risk, and every opportunity to earn more efficiently.

👉 Go directly to the official site, connect your wallet, and start staking ETH like a pro.

💡 What Is Lido and Why It Dominates the Market

Lido is not just another staking protocol — it’s the liquidity engine of Ethereum.

Before Lido, staking meant 32 ETH, uptime, and node setup.

Now you can stake any amount — as low as 0.1 ETH — and earn rewards seamlessly.

Lido pools ETH from users worldwide, delegates it to trusted validators, and mints stETH — your liquid staking token, a 1:1 representation of your staked ETH.

Your stETH balance grows automatically as rewards are distributed daily.

You can trade, lend, LP, or hold your stETH.

Your ETH never stops moving — and that’s what makes Lido the king of Ethereum staking.

⚙️ How Lido Staking Works (Simplified)

- Deposit ETH on the verified Lido staking interface.

- Lido smart contracts automatically distribute it among professional validators.

- You instantly receive stETH in your wallet.

- Your stETH balance grows continuously as you earn staking rewards.

No validator setup, no technical headaches, and no waiting.

Just connect, stake, and earn.

And when you want to unstake — it’s just as easy.

Withdraw directly through Lido or swap your stETH for ETH instantly on DEXs like Curve, Uniswap, or 1inch.

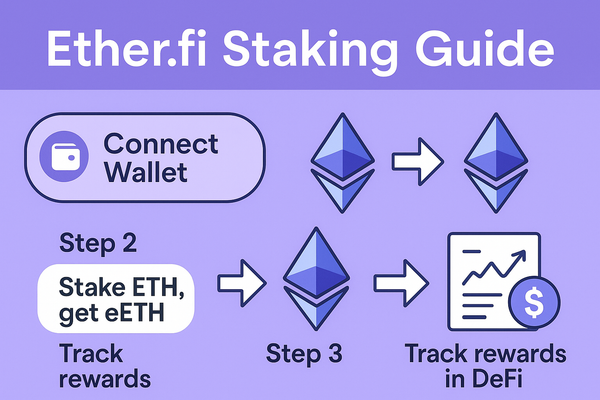

🔗 Step 1 — Connect Your Wallet

Go to the official site — the verified Lido portal.

Be cautious: fake Lido clones exist.

Always confirm the URL and bookmark it.

Now click “Connect Wallet” and choose from:

- 🦊 MetaMask

- 💎 Rabby

- 🔐 Ledger / Trezor (hardware wallets)

Ensure your network is set to Ethereum Mainnet.

Once connected, your wallet balance will display at the top.

💰 Step 2 — Choose the Amount of ETH to Stake

Decide how much ETH you want to put to work.

You can stake any amount — no 32-ETH minimum here.

⚠️ Tip: Always leave a little ETH for gas (0.01–0.05 ETH).

Confirm your input and review the on-screen summary:

- Amount of ETH you’re staking

- Expected stETH received

- Any minor protocol or gas fee

Then hit Stake ETH, confirm in your wallet, and within seconds, you’ll join the Lido validator pool.

🎉 Step 3 — Receive stETH Instantly

Congratulations — you’ve just entered the world of liquid staking.

Your stETH token represents your staked ETH and automatically tracks rewards.

💎 No need to claim. No need to re-stake.

Your stETH balance simply grows — block by block, day by day.

If you don’t see the token, add it manually using Lido’s interface.

You now hold a yield-bearing asset, earning rewards continuously while staying liquid.

📈 Step 4 — Watch Your Rewards Grow Every Day

Lido distributes staking rewards automatically through a rebasing system.

That means your stETH balance increases automatically as the network generates rewards.

- 💰 Rewards are distributed daily.

- 🧮 No manual claims — everything compounds automatically.

- 💎 Average annual yield: 3.5%–6.0% APY, depending on Ethereum validator performance and network conditions.

Your capital stays on-chain, non-custodial, and productive.

🪙 Step 5 — Use stETH Across DeFi

Here’s where Lido truly shines.

Your ETH is staked — but your stETH is liquid.

You can use stETH everywhere:

- 💸 Borrow stablecoins against it on Aave or MakerDAO.

- 🔁 Provide liquidity with stETH/ETH pairs on Curve or Uniswap.

- 🪙 Deposit into yield aggregators for extra rewards.

- 💼 Trade or hedge your exposure.

You’re earning staking yield plus DeFi yield — a double income strategy.

That’s how the smartest players maximize ETH productivity.

💎 Why Lido Leads the Liquid Staking Revolution

Lido dominates because it gives you the three essentials of modern DeFi:

✅ Liquidity — no lockups, instant access to funds.

✅ Security — audited smart contracts and DAO-managed validators.

✅ Utility — deep integrations across DeFi.

It’s fully decentralized, community-governed, and built to scale.

When you stake through Lido, you’re not just earning — you’re participating in the backbone of Ethereum itself.

⚔️ Risks: Be Realistic and Smart

Even the best systems have risk. Here’s what to know:

- Smart Contract Risk: Audited, but no code is 100% safe.

- Validator Risk: Slashing can happen, though rare with Lido’s diversified operators.

- Market Risk: stETH may temporarily trade below ETH price — usually short-term.

- Governance Risk: DAO votes can change parameters (fees, validator sets).

💡 Always diversify, monitor your exposure, and use hardware wallets for maximum safety.

🔥 Advanced Strategy — Leveraged Liquid Staking

Want to boost returns? Try looping strategies used by DeFi power users:

- Deposit ETH into Lido → receive stETH.

- Supply stETH as collateral on Aave.

- Borrow ETH → re-stake it via Lido.

- Repeat.

This multiplies yield — but also multiplies risk.

If ETH price drops, your position could be liquidated.

⚠️ Maintain Health Factor > 1.8 and monitor markets closely.

🧾 Unstaking and Withdrawals

You’ve got two options when it’s time to exit:

1️⃣ Withdraw via Lido Protocol

Head to the Withdraw tab on the official site.

Select your stETH amount and confirm.

Your withdrawal enters a queue (depends on Ethereum validator exit cycles).

Once processed, ETH arrives back in your wallet.

2️⃣ Swap Instantly via DEXs

If you need your ETH right away, trade stETH → ETH on Curve or Uniswap.

It’s instant and efficient, with minimal slippage.

Either way, you’re in control — not locked in.

🔐 Security Checklist

✅ Always use hardware wallets (Ledger, Trezor).

✅ Bookmark and verify the official site.

✅ Never click fake “airdrop” links.

✅ Keep your private keys offline.

✅ Regularly revoke old token approvals.

Simple rules. Big protection.

💬 FAQ — Common Questions

Q: What is stETH?

A: A liquid token representing your staked ETH and ongoing rewards.

Q: How soon do rewards start?

A: Immediately — rewards reflect daily via balance updates.

Q: Is there a lock-up period?

A: No. You can exit anytime through Lido or swap on a DEX.

Q: What’s the APY?

A: Typically 4–6%, fluctuating with Ethereum performance.

Q: Can I use stETH in DeFi?

A: Absolutely — it’s integrated across all major protocols.

🏛️ Governance and the Lido DAO

Lido isn’t controlled by a company — it’s governed by the Lido DAO.

All key decisions — validator additions, fee changes, protocol upgrades — are made by community proposals and votes.

The DAO operates transparently and rewards long-term contributors.

That’s true decentralization in action.

🌍 Lido’s Impact and Future Vision

Lido already dominates the Ethereum staking market with billions in total value locked.

But the future is even bigger:

- Expansion to other chains (Polygon, Solana, etc.)

- Deeper DeFi integrations

- Potential restaking mechanisms with EigenLayer

The goal?

Make liquidity and staking powerfully unified — accessible to everyone.

⚡ Final Thoughts — Stake Smart, Stay Liquid

Every minute your ETH lies idle, you’re losing yield.

Lido transforms that idle ETH into a yield-generating machine.

It’s fast, decentralized, and completely non-custodial.

✅ Connect wallet

✅ Stake ETH

✅ Earn stETH

✅ Grow rewards every day

👉 Go to the official site now, stake your ETH, and step into the new era of liquid Ethereum.

Lido doesn’t just let you stake — it lets you own the staking game. 💧🔥