Ether.fi Staking Guide | Stake Ethereum and Earn eETH Rewards 💧⚡

Ethereum is evolving fast — and Ether.fi stands at the forefront of that revolution.

This isn’t just staking. This is restaking, liquidity, and yield combined into one powerful protocol.

With Ether.fi, your ETH doesn’t sit idle — it earns, moves, and multiplies while staying completely under your control.

This guide shows exactly how to stake Ethereum through Ether.fi, claim your eETH or weETH, and turn your ETH into a dynamic, yield-generating asset.

👉 Go to the official site, connect your wallet, and start staking ETH in minutes.

💡 What Makes Ether.fi Special?

Ether.fi isn’t a typical staking platform.

It’s a liquid restaking protocol that lets you deposit ETH, receive a liquid token (eETH), and keep full control of your assets.

Unlike classic staking, where funds get locked and yield is slow, Ether.fi gives you instant liquidity — your eETH starts working from day one.

And when you wrap eETH into weETH, you unlock even more DeFi opportunities.

⚙️ How Ether.fi Works

Here’s the simple flow:

1️⃣ You deposit ETH through Ether.fi.

2️⃣ Validators stake it on the Ethereum network.

3️⃣ You instantly receive eETH (liquid staking token).

4️⃣ Rewards accumulate automatically — no claiming required.

5️⃣ Optionally wrap eETH → weETH for DeFi compatibility.

Your ETH remains productive, flexible, and secure — all at the same time.

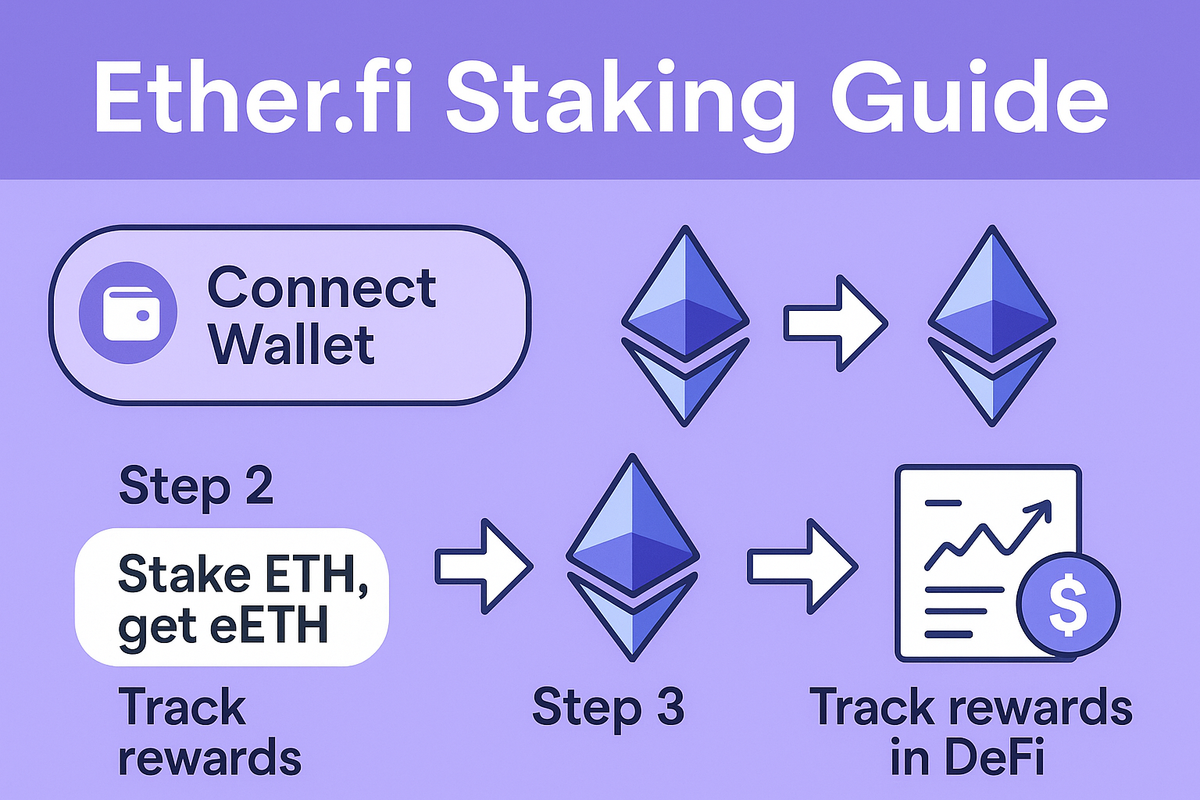

🔗 Step 1 — Connect to the Official Site

Start at the official site.

This is critical — scammers love to imitate popular DeFi protocols.

Click Connect Wallet, then choose:

- 🦊 MetaMask

- 💎 Rabby

- 🔐 Ledger / Trezor

- 🌐 WalletConnect

Confirm the connection and ensure your network is Ethereum Mainnet.

You’ll now see your balance and the staking dashboard.

💰 Step 2 — Deposit ETH

Enter the amount of ETH you’d like to stake.

You can start small — even fractions of ETH work.

⚠️ Keep a gas buffer (at least 0.01 ETH).

Review:

- ETH amount

- eETH received

- Estimated APY

Then click Stake ETH, approve in your wallet, and wait for the confirmation.

Boom — your ETH is now staking through Ether.fi, and your rewards are live.

💎 Step 3 — Receive eETH Instantly

Within seconds, you’ll see eETH in your wallet.

If it’s not visible, simply import the token contract from the interface.

Your eETH = staked ETH + rewards.

Every day, it grows automatically through rebasing — no manual claiming.

That’s pure, automatic yield.

🔁 Step 4 — Wrap eETH to weETH

Some DeFi platforms prefer non-rebasing tokens — that’s where weETH comes in.

Click Wrap eETH → weETH directly on the Ether.fi dashboard.

Approve the transaction, and your eETH becomes weETH — a wrapped ERC-20 version ideal for:

- Lending

- Farming

- Collateral on DeFi platforms

- Trading

💡 eETH = rebasing token (balance increases).

💡 weETH = wrapped token (value increases).

Both earn yield — just choose which fits your strategy.

📈 Step 5 — Earn and Monitor Rewards

Your ETH now generates daily rewards.

Rewards depend on:

- Validator performance

- Network yield

- Restaking activity through EigenLayer

You can check your updated APY and total balance anytime on the dashboard.

Ether.fi typically offers 4–6% APY, with potential boosts from restaking integrations.

🧠 Restaking: The Next Level

“Restaking” means using your staked ETH to secure other protocols (called AVSs — Actively Validated Services).

Ether.fi integrates with EigenLayer, allowing your staked ETH to participate in these services for extra yield.

It’s yield on top of yield — but also extra risk, since restaked ETH may be subject to additional slashing conditions.

You decide whether to opt in.

💼 Step 6 — Use eETH or weETH in DeFi

Here’s where the fun begins:

Your staked ETH (now eETH or weETH) isn’t locked — it’s liquid.

Use it across DeFi for multiple income streams:

- 💸 Lend on money markets (e.g., Aave, Compound).

- 🔁 Provide liquidity on DEXs with eETH/ETH pairs.

- 🪙 Borrow stablecoins against weETH.

- 💰 Yield farm with DeFi aggregators.

Your ETH earns rewards, your tokens stay mobile — you’re compounding yield while staying liquid.

🔄 Step 7 — Withdraw Anytime

When you’re ready to exit, you have two easy options:

1️⃣ Protocol Unstake

Go to the Withdraw tab on the official site.

Select your eETH amount and confirm.

After a short queue (depends on network conditions), you’ll receive ETH back in your wallet.

2️⃣ Instant Swap

Swap eETH → ETH or weETH → ETH on a DEX like Curve or Uniswap.

This is instant — though you’ll pay a small spread.

Either way, your liquidity remains intact.

🧾 Understanding Rewards and Fees

Ether.fi rewards come from:

- Ethereum staking yield

- MEV & priority fees

- Potential restaking incentives

Fees include:

- Protocol fee (small, transparent)

- Gas costs for deposits/withdrawals

Everything else is automatic and non-custodial.

You keep your keys. You keep control.

🧩 Advanced Strategies

💥 1. Looping

Stake ETH → receive eETH → use eETH as collateral → borrow ETH → stake again.

Repeat carefully for leveraged yield.

💥 2. DeFi Farming

Deposit weETH in yield farms for additional APR.

💥 3. LP Exposure

Provide liquidity on Uniswap eETH/ETH pools.

💥 4. Restaking

Enable EigenLayer restaking for bonus rewards (higher risk, higher gain).

🛡️ Security and Risk

Ether.fi is audited and transparent — but every on-chain system carries some risk.

- Smart-contract risk: mitigated through audits.

- Validator risk: minor risk of slashing.

- Market risk: eETH may temporarily depeg from ETH.

- Restaking risk: extra exposure to AVS performance.

✅ Best Practices:

- Use hardware wallets.

- Verify URLs.

- Revoke unused allowances.

- Diversify your strategies.

💬 FAQ — Quick Answers

Q: What is eETH?

A: A rebasing token representing your staked ETH and rewards.

Q: What is weETH?

A: Wrapped eETH — fixed supply ERC-20 for DeFi use.

Q: What’s the APY?

A: Typically 4–6%, variable with Ethereum yield and restaking boosts.

Q: Is there a lockup?

A: No. You can unstake anytime through the app or DEX.

Q: Can I restake rewards?

A: Yes — either manually or via DeFi compounding.

🌍 Governance and Expansion

Ether.fi is community-governed, DAO-driven, and expanding rapidly across chains.

Upcoming features include:

- Cross-chain staking assets.

- Institutional restaking integrations.

- Advanced validator selection tools.

It’s building the foundation for liquid restaking dominance.

⚡ Final Thoughts — Stake Smart. Stay Liquid.

Your ETH deserves to work.

With Ether.fi, it doesn’t just stake — it evolves.

You keep control, liquidity, and rewards — all in one protocol.

✅ Connect wallet.

✅ Stake ETH.

✅ Receive eETH or weETH.

✅ Earn yield daily.

✅ Withdraw anytime.

👉 Visit the official site and experience the next generation of Ethereum staking.

This isn’t just yield — this is financial evolution on-chain.

Stake smart. Stay liquid. Earn endlessly. 💧🔥