Aave Staking ETH Guide | Step-by-Step Tutorial to Earn Rewards 💎🚀

DeFi isn’t just about lending anymore — it’s about making every coin you hold earn.

And when it comes to security, governance, and yield, Aave remains the titan of decentralized finance.

In this ultimate Aave Staking ETH Guide, you’ll learn how to stake Ethereum on Aave, how the Safety Module works, how to earn AAVE rewards, and how to manage your liquidity while staying in full control of your assets.

👉 Go to the official site — connect your wallet, choose your amount, and start staking ETH today.

💡 What Is Aave Staking and Why It Matters

Aave is more than just a lending platform — it’s a full-scale decentralized liquidity protocol.

But behind its lending engine lies another critical layer: the Safety Module (SM) — a staking contract where AAVE and ETH holders can lock their tokens to backstop the protocol and earn rewards in return.

When you stake on Aave, you’re not just earning yield — you’re supporting the security of DeFi’s largest liquidity protocol.

- 🔒 Stake ETH or AAVE into the Safety Module.

- 💰 Earn yield in AAVE tokens.

- 🛡️ Protect the ecosystem from bad debt events.

Aave rewards responsibility — you get paid for helping secure the protocol.

⚙️ How Aave ETH Staking Works

Here’s the breakdown in simple terms:

1️⃣ You deposit ETH into the Aave Safety Module.

2️⃣ The smart contract locks your ETH for a predefined cooldown period.

3️⃣ You earn AAVE token rewards continuously while staking.

4️⃣ After the cooldown, you can unstake anytime or restake for compound returns.

Your ETH never leaves your control — it stays within the smart contract, protected by the protocol.

Rewards are funded through Aave’s emission schedule and distributed to stakers proportional to their stake.

🔗 Step 1 — Visit the Official Aave Platform

Head to the verified official site — this is your direct access to the Aave Safety Module.

⚠️ Always verify URLs! There are fake interfaces imitating Aave to steal wallets.

Bookmark the real one now.

Once there, you’ll see the “Stake” dashboard, where you can choose between staking AAVE tokens or ETH (via the Safety Module).

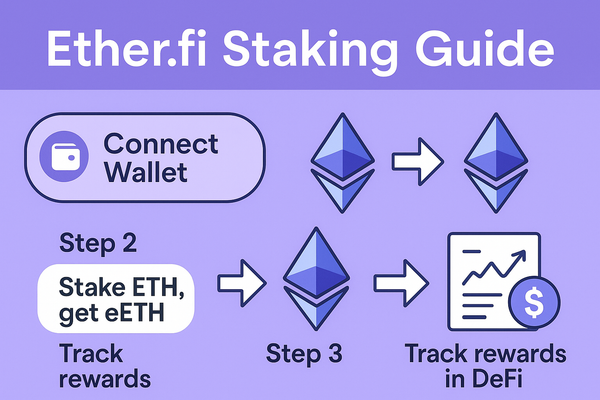

👛 Step 2 — Connect Your Wallet

Click “Connect Wallet” at the top-right corner.

Choose your preferred wallet:

- 🦊 MetaMask

- 💎 Rabby

- 🔐 Ledger / Trezor (hardware wallet)

- 🌐 WalletConnect

Approve the connection prompt.

Make sure your network is set to Ethereum Mainnet, since all Aave staking contracts live there.

Once connected, you’ll see your wallet balance and staking options appear automatically.

💰 Step 3 — Choose ETH Staking (Safety Module)

Select “Stake ETH” on the main panel.

Enter the amount of ETH you want to stake — remember to leave a little ETH in your wallet for gas fees.

You’ll see a summary window with details:

- Amount of ETH staked

- Estimated APY in AAVE rewards

- Cooldown period information

- Current reward pool size

Confirm everything looks good.

Then click Stake Now, approve the transaction, and wait for Ethereum to process it.

Boom. Your ETH is now part of the Aave Safety Module, securing billions in DeFi liquidity — and earning you yield.

🎉 Step 4 — Start Earning Rewards Automatically

The moment your stake is confirmed, your rewards begin accumulating.

Aave rewards are distributed automatically — there’s no need to claim manually every block.

You can check your real-time APY and reward balance directly on the staking interface.

Rewards are paid in AAVE tokens, which you can:

- 🪙 Hold and vote on governance proposals.

- 💸 Swap for ETH or stablecoins on DEXs.

- 🔁 Restake for compounding returns.

Passive income meets active governance.

⏳ Step 5 — Understanding the Cooldown and Unstaking

Aave staking has a cooldown mechanism to protect the protocol’s integrity.

When you initiate an unstake, you must wait a cooldown period (typically 10 days) before withdrawing your ETH.

Here’s how it works:

1️⃣ Click “Activate Cooldown” in the staking dashboard.

2️⃣ Wait for the cooldown to complete.

3️⃣ Once done, click “Withdraw” and confirm the transaction.

During the cooldown, your funds still earn rewards — but can’t be withdrawn until the timer ends.

This system protects Aave’s liquidity and ensures fair participation during protocol events.

🧠 Why Aave Staking Is Worth It

Let’s be honest — Aave’s staking yield isn’t just about percentages.

It’s about power, protection, and participation in one of the safest ecosystems in crypto.

- 💸 APY: 6–10% on average (varies by market conditions).

- 🛡️ Safety: You help safeguard Aave against shortfall events.

- 🔗 Decentralization: No intermediaries — all smart contract based.

- 💧 Flexibility: You can restake or exit whenever the cooldown allows.

It’s not just staking — it’s staking with purpose.

💎 Aave’s Safety Module Explained

The Safety Module (SM) is Aave’s last-resort backstop for extreme conditions.

If ever the protocol experiences a shortfall (for example, liquidations failing due to volatility), up to 30% of staked assets can be used to cover the deficit.

That’s why it’s called the Safety Module — it literally secures the entire ecosystem.

In exchange for taking that theoretical risk, Aave stakers earn generous rewards and governance power.

Every ETH you stake strengthens Aave’s position as the most trusted DeFi lending platform.

📈 Compounding Rewards Like a Pro

Here’s how to maximize your earnings:

1️⃣ Stake ETH via the official site.

2️⃣ Wait for rewards to accumulate (daily).

3️⃣ Claim AAVE tokens periodically.

4️⃣ Swap or restake them to compound growth.

💡 Advanced Strategy:

Stake ETH → earn AAVE → swap AAVE for more ETH → stake that ETH again.

Repeat the loop.

This recursive method lets you compound both ETH and AAVE exposure for exponential gains — just keep gas costs in mind.

| Feature | Aave ETH Staking | Traditional Staking |

|---|---|---|

| Liquidity | Partial (after cooldown) | Often locked |

| Yield Type | AAVE rewards | Native token yield |

| Risk | Smart contract risk | Validator risk |

| Governance Rights | ✅ Yes | ❌ No |

| Use of Funds | Safety backstop | Network security |

Aave gives you DeFi-native control — a dynamic, reward-driven system built for professionals, not passive holders.

🪙 AAVE Token Utility

The AAVE token is more than a reward — it’s your voice in the ecosystem.

Stakers can vote on:

- Fee structures

- Emission rates

- Asset listings

- Risk parameters

By staking ETH (or AAVE itself), you earn both yield and influence — a rare combo in DeFi.

🧩 Integrations and DeFi Synergy

The beauty of staking ETH via Aave is how seamlessly it connects to the wider DeFi universe:

- 🧠 Use your AAVE rewards as collateral elsewhere.

- 🔁 Participate in liquid staking protocols to maintain flexibility.

- 💼 Combine Aave staking with yield farming strategies.

- 💸 Borrow against your earned AAVE to fund other investments.

Every piece of your staking portfolio stays productive.

⚔️ Risk Management — What You Must Know

Staking ETH on Aave is relatively low-risk, but not risk-free.

Be aware of:

- Smart Contract Risk: Audited but not immune.

- Slashing Risk: In rare shortfall events, up to 30% of staked assets may be used.

- Market Risk: Reward token (AAVE) price fluctuates.

- Governance Risk: DAO decisions may impact APY or lock rules.

🛡️ Best Practice: Diversify across protocols and maintain long-term confidence in Aave’s stability.

🧾 Taxes and Reporting

Depending on your jurisdiction, staking rewards may be treated as taxable income.

Keep track of:

- ETH staked

- AAVE earned

- Transaction timestamps

Use crypto tax software like Koinly or CoinTracking for compliance.

💬 FAQ — Aave ETH Staking Simplified

Q: Can I stake any amount of ETH?

A: Yes — even small amounts, as long as you have enough for gas fees.

Q: When do rewards start?

A: Immediately after your stake is confirmed on-chain.

Q: Can I unstake anytime?

A: Yes, after completing the cooldown period (usually 10 days).

Q: Are rewards paid in ETH or AAVE?

A: AAVE tokens.

Q: Is it risky?

A: Only in extreme market conditions — otherwise, it’s one of DeFi’s safest mechanisms.

🌍 Why Aave Is a Pillar of DeFi

Aave isn’t just another platform — it’s infrastructure.

Billions in TVL. Hundreds of supported assets. Battle-tested through every bear market.

Its Safety Module represents the ultimate proof of confidence — users willingly lock ETH to secure the protocol they trust.

That’s DeFi maturity. That’s community-backed resilience.

⚡ Final Thoughts — Stake. Earn. Secure. Repeat.

If you’re serious about ETH yield, there’s no reason to ignore Aave.

It’s a blend of security, passive income, and governance power — all under your control.

✅ Connect your wallet.

✅ Stake ETH through the official site.

✅ Earn AAVE rewards automatically.

✅ Unstake anytime after cooldown.

You’re not just staking ETH — you’re staking into DeFi’s foundation.

This is the future of financial independence.

This is Aave Staking — where security meets yield, and ETH never sleeps. 💎🔥